- DISCOVER IT MILES CARD VS CAPITAL ONE VENTURE ONE FOR FREE

- DISCOVER IT MILES CARD VS CAPITAL ONE VENTURE ONE FREE

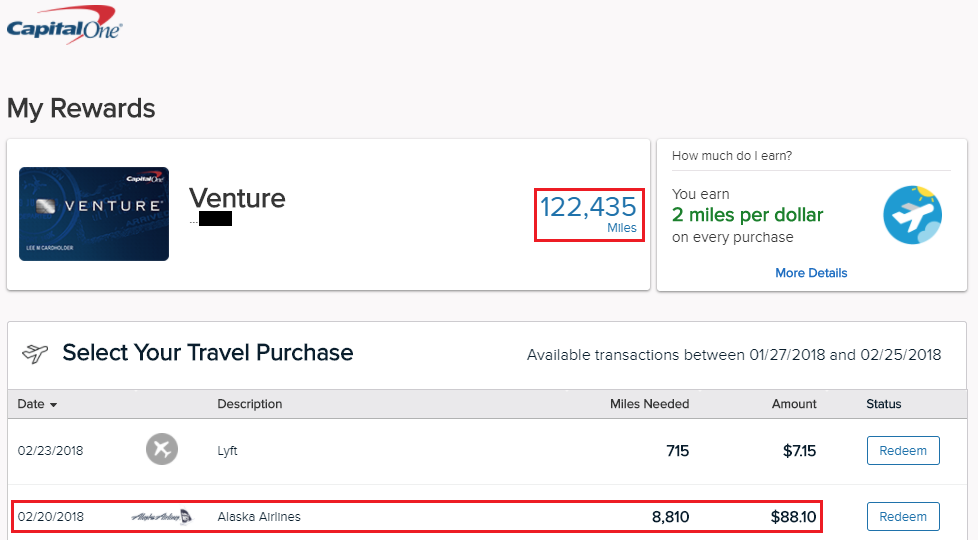

Image Credit: Capital OneĮach of our featured cards has its own specific requirements to get approved for the card. Strive for no less than 1 cent per mile in value.Ĭapital One offers cards that are designed for every level of credit history. However, not all options provide good value. Additional Redemption Options - Redeem miles for gift cards, shopping at Amazon, statement credits, and more.Purchase Travel via Capital One Travel - Receive 1 cent per mile in value when purchasing travel via the Capital One Travel portal.

DISCOVER IT MILES CARD VS CAPITAL ONE VENTURE ONE FREE

Transfer to Travel Partners - Receive the highest potential value for your miles by transferring to airline and hotel loyalty programs and purchasing award travel or free hotel nights.Here are your options for redeeming your Capital One miles: While the Capital One Platinum card doesn’t earn rewards, miles earned on the Capital One VentureOne card and Capital One Venture card offer several redemption options. Image Credit: Sergio Shumoff via Shutterstock

DISCOVER IT MILES CARD VS CAPITAL ONE VENTURE ONE FOR FREE

Redeem Capital One miles for free flights by transferring to airline loyalty programs. The Capital One Venture card charges a $95 annual fee but has the highest earning level of at least 2 miles per dollar spent on every purchase.

The Capital One VentureOne card earns modest rewards but does not charge an annual fee. Let’s look at how our 3 featured cards compare when it comes to earning rewards: Cardīottom Line: The no-annual-fee Capital One Platinum card is designed primarily for building credit and does not earn rewards. Earning RewardsĬapital One is known for its simplistic earning structures, so you’ll always know how many Capital One miles you’ll earn on every purchase you make. If you’d like to learn more about how the 2 rewards-earning cards compare, we’ve put together a detailed comparison of the Capital One VentureOne card vs. We’ll cover more on redemption options shortly.

However, you could receive potentially greater value when utilizing the option to transfer miles to travel partners and use them for flights or hotel nights. Miles can generally be redeemed for 1 cent each, so a 75,000-mile welcome bonus would equal $750 in travel value. Keep in mind that welcome bonuses can change, but we’ve shown a snapshot above of the current applicable welcome bonuses and spending requirements. While the Capital One Platinum card does not offer a welcome bonus, the Capital One VentureOne card and Capital One Venture card each offer a welcome bonus in the form of Capital One miles earned when you complete minimum spending requirements within the first 3 months after card approval. TSA PreCheck or Global Entry fee reimbursement, up to $100, every 4 years

Join us as we discuss the Capital One Platinum Credit Card, the Capital One VentureOne Rewards Credit Card, and the Capital One Venture Rewards Credit Card.Ĭapital One Platinum Card vs. We’re comparing 3 Capital One cards today, each designed for a consumer with a specific level of credit history. We’ll cover what it takes to qualify for each card, compare the features and benefits, and if applicable, how you can earn and redeem rewards. There’s a Capital One card right for you.Ĭonversely, if you’ve worked hard to improve your credit history, you’ll find several card options that will allow you to earn rewards on every purchase you make. Perhaps you’d like to get started on the path toward securing a rewards-earning credit card, for example, but your credit history is not quite there yet. Capital One is a unique credit card issuer offering a large collection of cards with options appropriate for every credit rating.

0 kommentar(er)

0 kommentar(er)